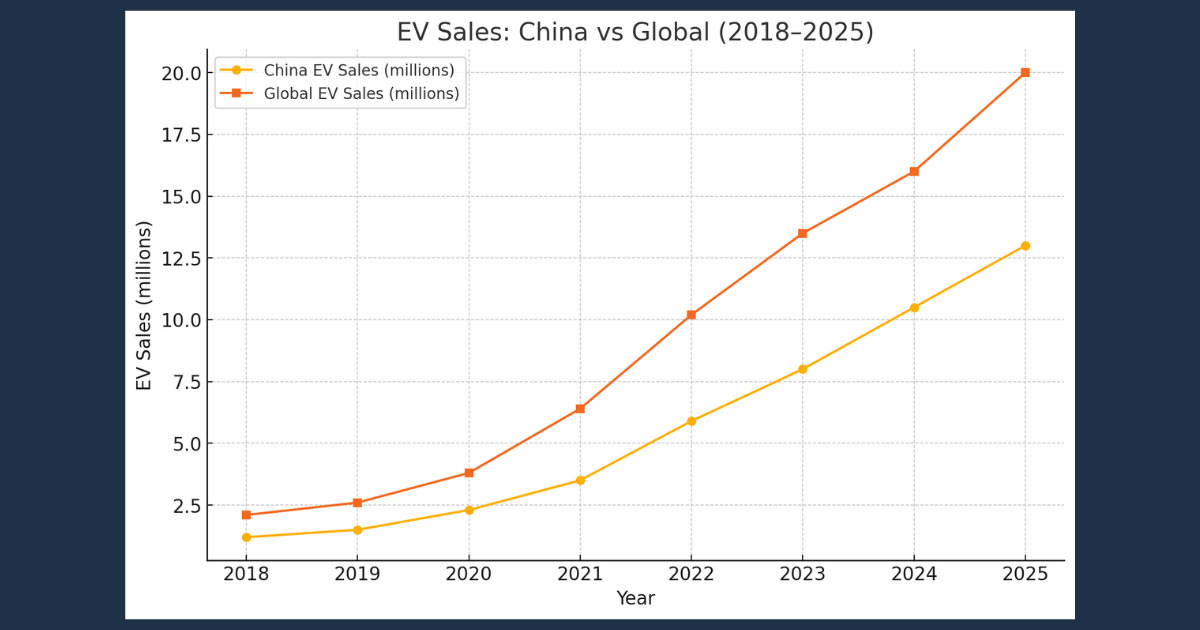

China’s rapid ascent in the electric vehicle (EV) sector is far more than a domestic industrial success—it represents a seismic shift with global repercussions. Through state-driven strategies, relentless innovation, and aggressive global expansion, China has positioned itself not only as a leader in EV manufacturing but also as a catalyst driving advancements across artificial intelligence, energy infrastructure, battery technology, and semiconductor development. As the world grapples with decarbonization goals and the transition to smart mobility, China’s trajectory is reshaping the competitive and technological contours of the 21st century.

At the core of China’s EV revolution is a state-engineered model of industrial policy. Since 2009, the Chinese government has funneled more than $230 billion in subsidies, tax incentives, infrastructure investment, and direct R&D funding into the EV sector. These initiatives were not isolated; they were part of a broader economic and geopolitical strategy encapsulated in policies like “Made in China 2025” and the 14th Five-Year Plan, which emphasize technological self-sufficiency and green transformation.

This strategic framework enabled firms such as BYD, NIO, XPeng, and Li Auto to operate within a supportive ecosystem—one that links manufacturers, universities, and tech giants like Huawei and Baidu in an innovation loop. These firms have invested heavily in proprietary technologies, particularly in powertrains, solid-state batteries, autonomous driving systems, and vertically integrated supply chains.

China is home to 6 of the top 10 battery manufacturers globally, with CATL (Contemporary Amperex Technology Co. Limited) and BYD leading the pack. CATL, which supplies batteries to Tesla, BMW, and Hyundai, has pioneered LMFP (lithium manganese iron phosphate) battery chemistry, boosting energy density, thermal stability, and cost efficiency.

CATL’s Qilin battery, launched in 2023, delivers up to 620 miles (1,000 km) on a single charge and can replenish 80% of its capacity in under 10 minutes using ultra-fast charging stations. These advances reduce “range anxiety” and represent a major leap over traditional lithium-ion battery performance.

Chinese EV makers are at the forefront of integrating AI and autonomous driving. XPeng’s XNGP platform offers a full-stack solution comparable to Tesla’s FSD (Full Self-Driving), aiming for Level 3 autonomy in urban environments by the end of 2025. NIO’s strategic collaboration with NVIDIA and use of Orin chips highlight China’s ambition to lead in AI-based mobility.

China’s edge lies in the scale of its real-world data collection, thanks to a vast domestic market and loose data privacy regulations—advantages that accelerate machine learning cycles and AI performance.

Chinese EVs now offer some of the most advanced in-cabin AI systems. NIO’s NOMI and BYD’s DiLink ecosystems provide real-time voice assistance, behavioral adaptation, and ecosystem integration with smartphones and smart homes. These platforms reflect China’s consumer electronics strength and its ability to embed digital intelligence into physical products—a convergence that Western automakers are only beginning to emulate.

China’s EV surge is fundamentally redrawing global auto industry dynamics. In 2023, China became the largest car exporter in the world, surpassing Japan. EVs accounted for over 60% of China’s automotive exports, with markets spanning Europe, Southeast Asia, and Latin America.

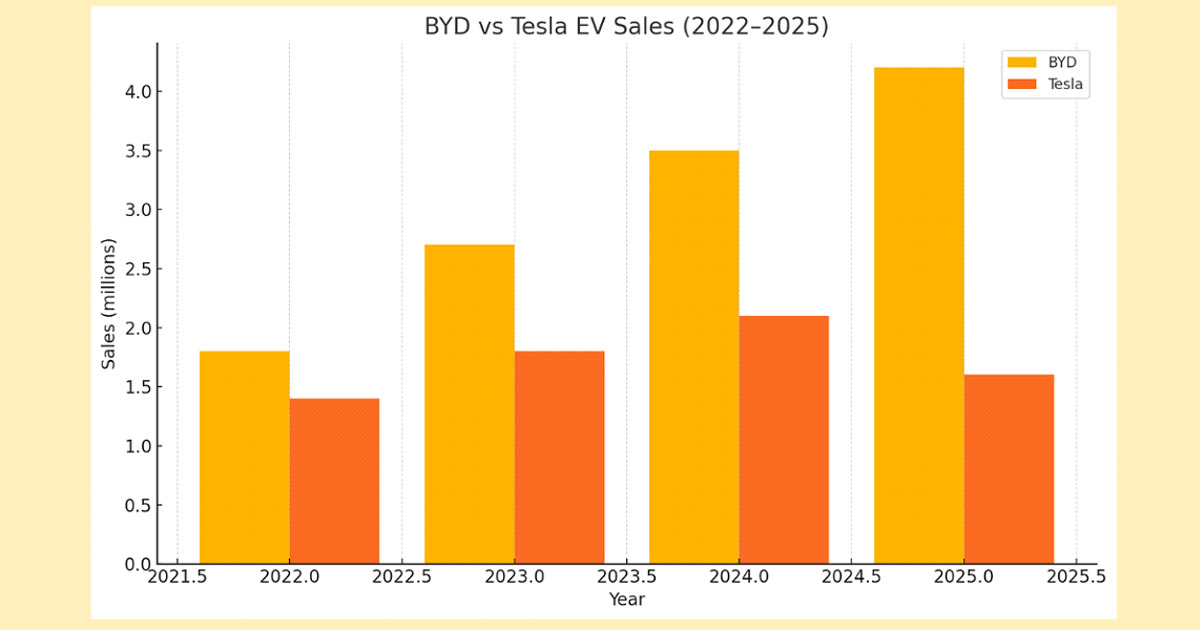

BYD, for instance, sold more than 1 million EVs in Q1 2025, nearly tripling Tesla’s figures for the same period. BYD’s aggressive pricing—enabled by vertical integration and low-cost domestic inputs—has made its models highly competitive globally, with some models undercutting European equivalents by over 30%.

This dominance is prompting a recalibration among traditional automakers and policymakers:

⦁ The U.S. and E.U. have proposed or enacted tariffs and local content requirements to curb Chinese imports.

⦁ India, Thailand, and Indonesia are incentivizing local EV production to reduce reliance on Chinese supply chains.

⦁ European automakers like Volkswagen and Renault are forming joint ventures in China to access technology and market reach.

Despite its strengths, China’s EV sector is not without vulnerabilities:

Domestic Challenges

⦁ Market saturation: Urban areas are nearing saturation, prompting a shift toward rural subsidies and export-oriented strategies.

⦁ Overcapacity risks: Fierce competition and rapid expansion may lead to unsustainable business models and margin pressures.

⦁ Data and cybersecurity concerns: The use of telematics and driver data in Chinese EVs has raised alarms in countries wary of espionage or surveillance risks.

Geopolitical Risks

⦁ U.S.-China tech decoupling threatens access to advanced chips used in AI and autonomous systems.

⦁ European regulatory scrutiny is mounting over subsidies and anti-competitive practices by Chinese automakers.

⦁ Raw material dependencies, especially lithium and rare earth metals, are becoming strategic flashpoints as countries seek to secure supply chains.

Looking ahead, China’s EV industry is poised to not only maintain momentum but also shape global technological standards. Its investments in solid-state batteries, vehicle-to-grid (V2G) integration, and green hydrogen technologies are forging new pathways for sustainable mobility.

Moreover, China’s strategy serves as a model of how state-led capitalism can accelerate innovation in critical sectors. For emerging economies, it offers a playbook for leapfrogging industrial development stages; for advanced economies, it serves as both a competitive threat and a stimulus for innovation.

The next five years will likely see increased polarization—technological decoupling on one hand and forced collaboration in climate-related tech on the other. Yet, whether as a partner, rival, or model, China’s EV surge will remain a defining force in the global transition to smart, sustainable mobility.