Cape Town — with its world-renowned scenery, diverse communities, and mature real estate market — remains one of Africa’s most dynamic property hubs. As of mid-2025, the city is navigating a complex balance between high demand, economic pressure, and a growing appetite for affordable housing.

Market Overview: Q2 2025

According to recent data from Lightstone, FNB, and Property24, Cape Town’s residential market is stabilizing after two years of uneven performance due to rising interest rates and inflationary pressures. However, property remains a safe and appreciating asset, especially for patient investors.

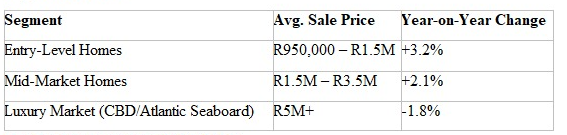

Segment Avg. Sale Price Year-on-Year Change

Entry-Level Homes R950,000 – R1.5M +3.2%

Mid-Market Homes R1.5M – R3.5M +2.1%

Luxury Market (CBD/Atlantic Seaboard) R5M+ -1.8%

Top Performing Areas (2024–2025):

Southern Suburbs: Constantia, Claremont, Kenilworth (stable demand from families)

Northern Suburbs: Durbanville, Brackenfell (affordable space for first-time buyers)

Atlantic Seaboard: Sea Point, Green Point, Camps Bay (international and local luxury market)

Top Performing Areas (2024–2025):

- Southern Suburbs: Constantia, Claremont, Kenilworth (stable demand from families)

- Northern Suburbs: Durbanville, Brackenfell (affordable space for first-time buyers)

- Atlantic Seaboard: Sea Point, Green Point, Camps Bay (international and local luxury market)

Rental Market

Cape Town’s rental yields remain strong, especially in areas like Observatory, Woodstock, and Bellville. Student housing, co-living spaces, and retirement developments are seeing an uptick in demand.

- Average gross yield: 5.8% – 7.3%

- Highest rental demand: R6,000 – R10,000/month bracket

- TPN Rental Index shows improved payment performance in Cape Town vs. national average

What’s Driving the Market

1. Semigration & Lifestyle Migration

There’s continued migration from Gauteng to the Western Cape — driven by lifestyle preferences, perceived service delivery quality, and safer urban environments. This trend benefits mid-market suburbs near good schools and healthcare.

2. Youth & First-Time Buyer Market

Thanks to new government-backed financing (like FLISP) and developer incentives, more young professionals are entering the market in suburbs like Kuils River, Eerste River, and Blue Downs.

3. Christian Property Groups & Community Projects

Several faith-based developers are active in mixed-income housing in areas like Mitchells Plain and Philippi, providing opportunities for ethical investment and community upliftment.

Challenges to Watch

- Interest Rates: The Prime lending rate is holding at 11.75%, limiting loan access for many buyers.

- Title Deed Delays: Especially for new affordable developments, delays in registration remain a pain point.

- Infrastructure Gaps: While Cape Town has stronger municipal governance, power outages and water restrictions continue to affect property desirability.

Faith-Based Investor Takeaway

As believers, we know real wealth is not just in bricks and land, but in what is built with purpose. Cape Town offers rare opportunities for long-term impact: homes that become sanctuaries, properties that provide stability, and investments that align with Christian values.

“By wisdom a house is built, and through understanding it is established.” – Proverbs 24:3

Invest wisely, with patience and faith, and Cape Town can offer both earthly value and eternal purpose.