In a remarkable turn of events, NVIDIA has once again ascended to the pinnacle of the global market, reclaiming its position as the world’s most valuable publicly traded company. This resurgence is attributed to the escalating demand for artificial intelligence (AI) infrastructure, solidifying NVIDIA’s dominance in the GPU industry and its pivotal role in the tech sector’s evolution.

NVIDIA’s market capitalization has soared to an impressive $3.45 trillion, surpassing tech giants like Microsoft and Apple. This milestone is not just a testament to the company’s financial prowess but also underscores the transformative impact of AI technologies across various industries.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The company’s stock experienced a significant boost following its first-quarter earnings report, which revealed revenues of $44.06 billion—a 69% year-over-year increase. This surge is primarily driven by the booming demand for AI chips, particularly in data centers and cloud computing services.

The rapid adoption of AI technologies has been a game-changer for NVIDIA. Its GPUs are now integral to the functioning of large language models, autonomous vehicles, and advanced robotics. The company’s latest Blackwell architecture, featuring the B100 and B200 datacenter accelerators, is at the forefront of this revolution, offering unprecedented performance and efficiency.

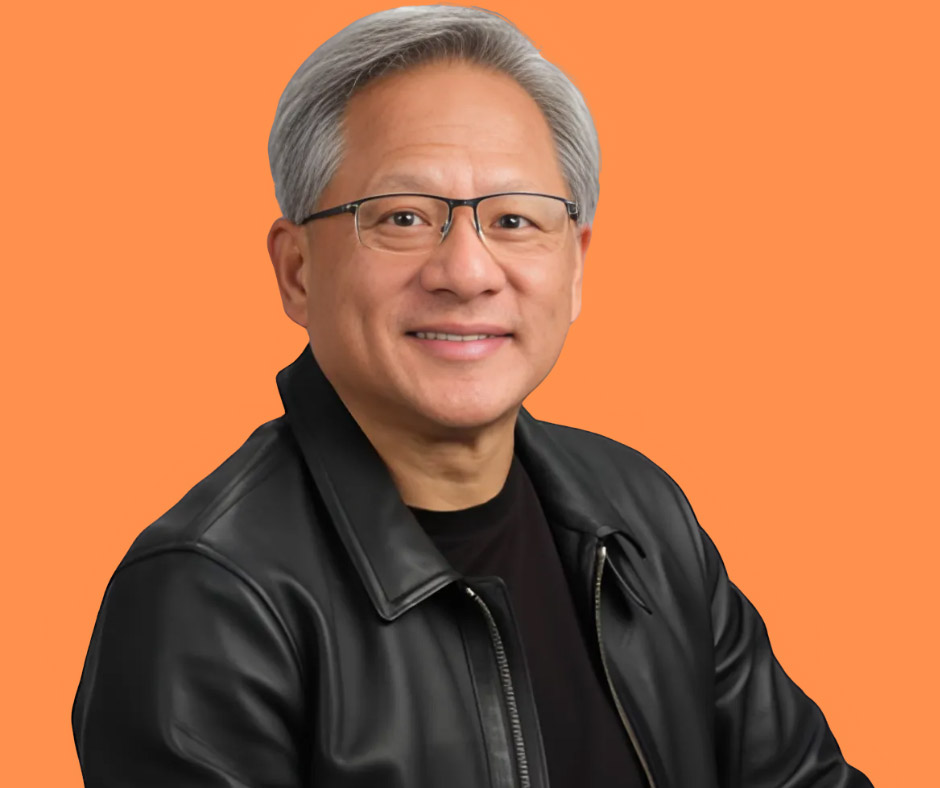

CEO Jensen Huang emphasized the significance of AI in his recent keynote at COMPUTEX 2025, stating, “AI is now infrastructure, and this infrastructure, just like the internet, just like electricity, needs factories.” He highlighted the company’s commitment to building AI factories that will serve as the backbone of future technological advancements.

NVIDIA’s success is also attributed to its strategic partnerships and global expansion efforts. The company has announced plans to invest up to $500 billion in building AI supercomputers entirely within the United States, marking a significant pivot toward domestic manufacturing. This initiative includes over a million square feet of manufacturing space in Texas, partnering with Foxconn in Houston and Wistron in Dallas.

Furthermore, NVIDIA has signed a Memorandum of Understanding with the Andhra Pradesh government in India to establish an Artificial Intelligence University in Amaravati. This collaboration focuses on infrastructure development, skill training, startups, and research in AI, aiming to make Andhra Pradesh a national AI leader.

Despite its impressive growth, NVIDIA faces challenges, particularly concerning U.S. export restrictions to China. These restrictions have impacted sales of its H20 AI processors, leading to an estimated $2.5 billion in lost sales. However, the company managed the situation better than expected, with the actual loss being $1 billion less due to material reuse.

Looking ahead, analysts remain optimistic about NVIDIA’s trajectory. The company’s per-employee value has surpassed $90 million, driven by its relatively small workforce of 36,000 employees. This figure vastly surpasses those of major competitors such as Broadcom, Apple, and Microsoft, highlighting NVIDIA’s operational efficiency and strategic positioning in the AI landscape.

NVIDIA’s resurgence as the world’s most valuable company is a testament to its visionary leadership, innovative technologies, and strategic partnerships. As AI continues to permeate various sectors, NVIDIA is poised to remain at the forefront of this transformative era, shaping the future of technology and society.